SIAPIK, Financial Transaction Recording Application For MSMEs

Innovation introduced in 2016

Institutions that have implemented the product/service: Bank Indonesia

MSMEs served: Indonesia, Jakarta

PDFChallenges

a. Unequal digital technology literacy.b. Unequal data (internet) and communication infrastructure.

Primary target

Which group does your product/service primarily target?

Cash Management

SMEs

Description of Innovation

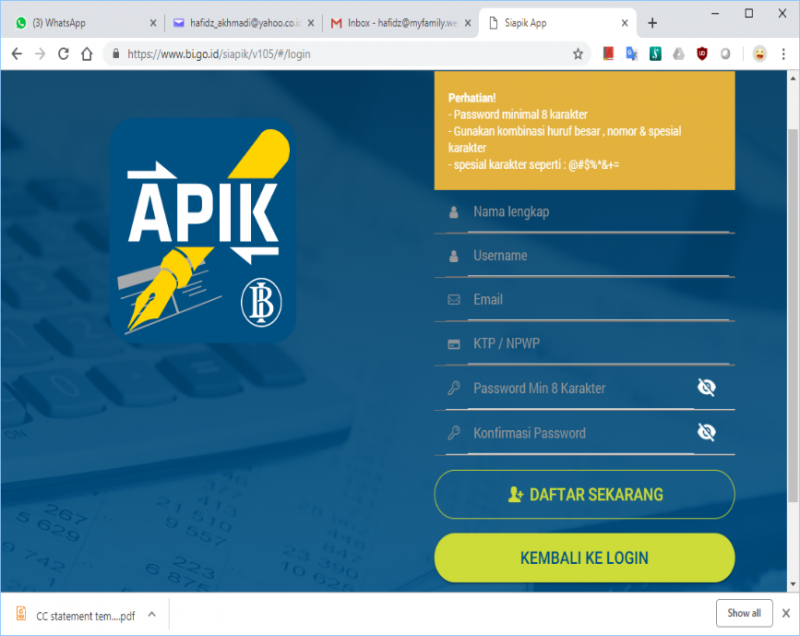

a. Standard: SIAPIK refers to the Application and web-based Financial Transactions Recording for Micro and Small Businesses which is created by Bank Indonesia and the Indonesian Institute of Accountants (IAI).b. Convenience: Free and easy download from Google Play Store and Apple App Store.

c. Effective: The application has a backup and restore feature to protect the data and it is stored safely on the phone (gadget) or on the cloud.

d. Simple: The input process is simple and easy to understand even for those who have basic knowledge of financial transaction reporting.

e. Reliable: SIAPIK can be used by MSMEs in various business sectors (such as: agriculture, accommodation, trading, manufacture, etc.) to create comprehensive, accurate and standardized financial report.

*SIAPIK web-based link: https://www.bi.go.id/siapik/v110/#/login SIAPIK is a simple, fast, and easy financial recording system application based on Mobile and Web.

Results

a. Reducing asymmetric information between financial institutions and MSMEs, especially in terms of the availability of financial transaction reports. Financial transaction report is important for financial institutions to assess the condition of MSMEs, so it will reduce the risk of MSMEs financing default.b. Improving MSMEs knowledge of financial transactions, especially those that are relate to revenues and expenditures. There are over 20 thousand SIAPIK users (as of 2021), of which 99% of them are micro business and 40% are from manufacture sector.

c. Increasing MSMEs access to financing. By 2021, there are more than 700 SIAPIK MSMEs users which have successfully been linked to the formal financial institutions and received the loan. SIAPIK has supported the availability of MSMEs financial information of which would increase the MSME financing and in the end help to attain the Government target of 30% share of financing to MSMEs by 2024.

d. Encouraging digital technology literacy of MSMEs.

Lessons Learnt

a. The use of SIAPIK by MSMEs needs intensive assistance. Bank Indonesia involves regional representative offices and stakeholders to provide capacity building and assistance program for MSMEs to use SIAPIK consistently.

b. Optimal use of SIAPIK requires manual guidelines to facilitate MSMEs. BI has formulated a manual guideline e-book of SIAPIK.

c. Equal availability of internet and telecommunication infrastructure in each region.

d. The acceptance of the financial institutions to further process the loan application of MSMEs based on financial report resulted from SIAPIK.

Policy for equitable availability of internet and telecommunication infrastructure in each region.