AceN-Navadhan: Tech-led Finance Platform for Rural MSMEs

Innovation introduced in 2021

Institutions that have implemented the product/service: Navadhan Capital, UGRO Capital, TruCap Finance, Pinnacle Capital, Caspian Impact, Vivriti Capital, Eclear Leasing & Finance, Samunnati Financials, Augmont and 10 other industry partners for different financial services.

MSMEs served: Madhya Pradesh (153 Pin codes)

PDFChallenges

Rural MSMEs being our target segment, it has typical annual income of Rs.4,00,000 – 40,00,000. They have borrowing history and seasonal but stable business incomes. AceN addresses below challenges in this segment:a. Digital push to the Cash Economy - Since AceN cater to audience in rural geography, majority use cash as the point-of-sale transaction. AceN with phygital model is capable of managing multiple mode of transactions with digital push to the segment

b. Assisted Tech for Rural India – AceN provides assisted tech support to all the customers

c. Varity and flexible of products – In the target segment, people have access to limited product from the financial institutes. AceN provides the variety and flexibility of products as per consumer requirements

d. Proprietary tools development: With the limited to no digital record of the businesses and other data, AceN is building the Proprietary tools based on surrogates to make it suitable for the segment

e. Unsatisfied demand – In the rural segment, most people are still dependent on informal sources of credit and multiple institutes with very limited other financial services. AceN is providing a full suite for the Rural MSMEs at one place

Primary target

Which group does your product/service primarily target?

Payments

SMEs

Savings

SMEs

Financial Education

SMEs

Credit Guarantees

SMEs

Description of Innovation

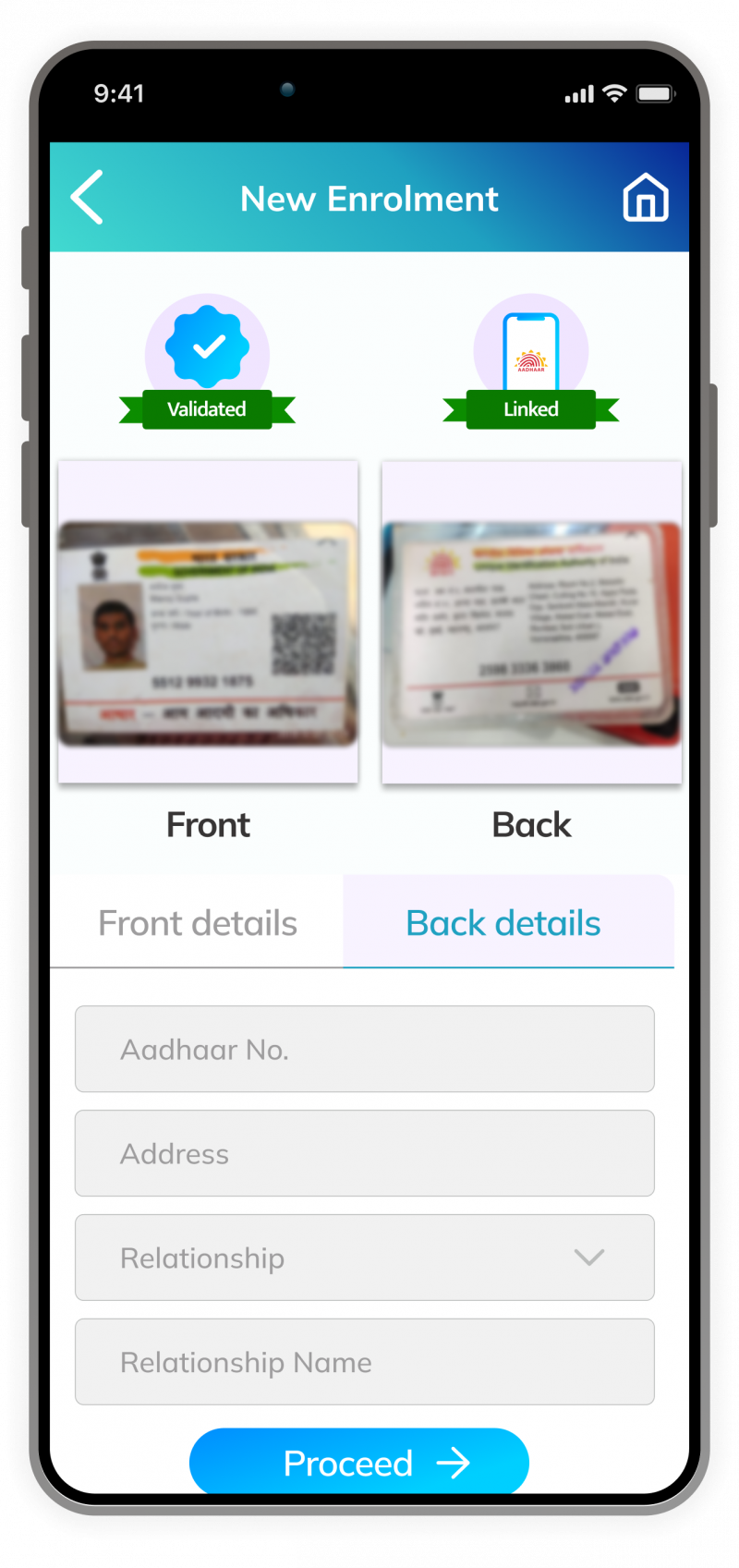

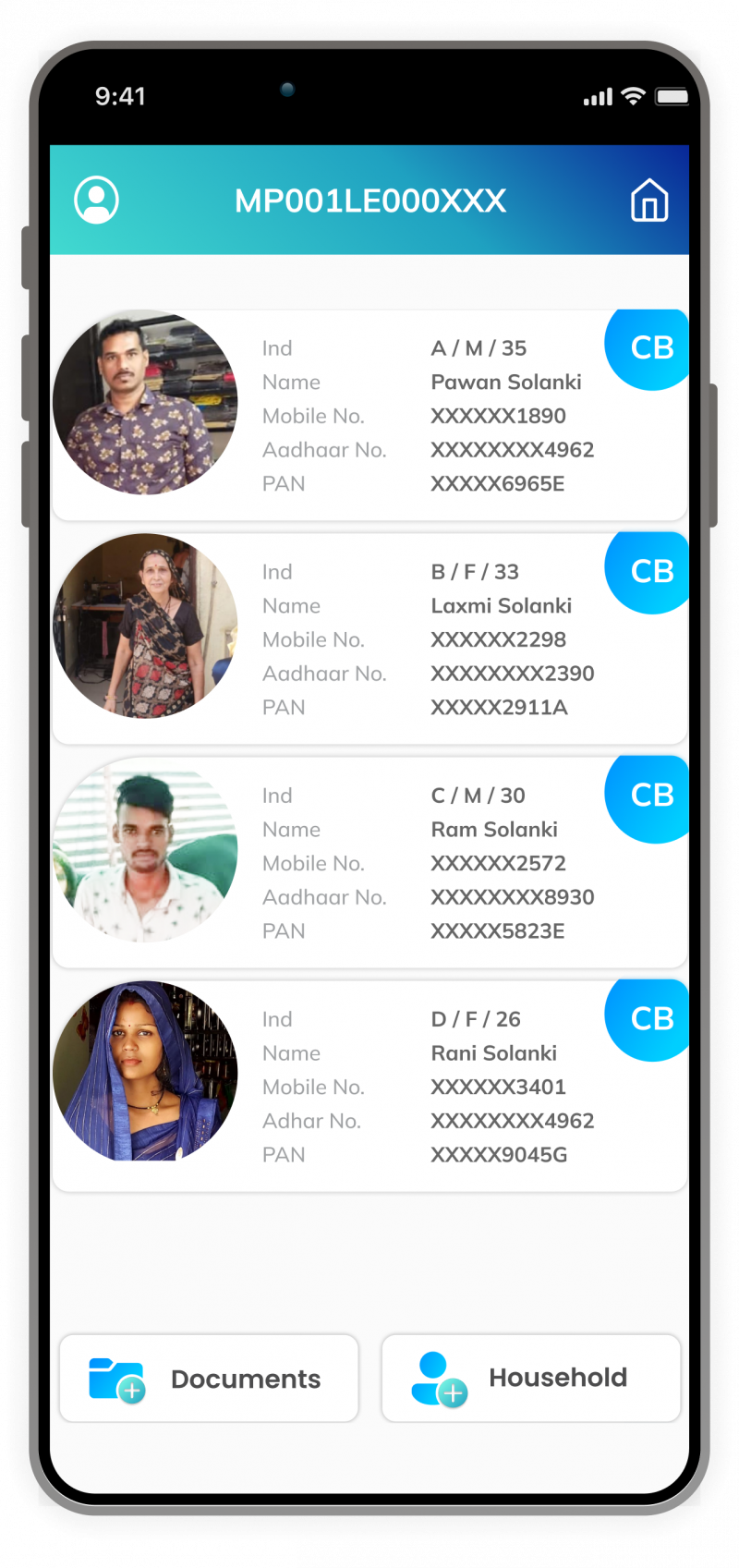

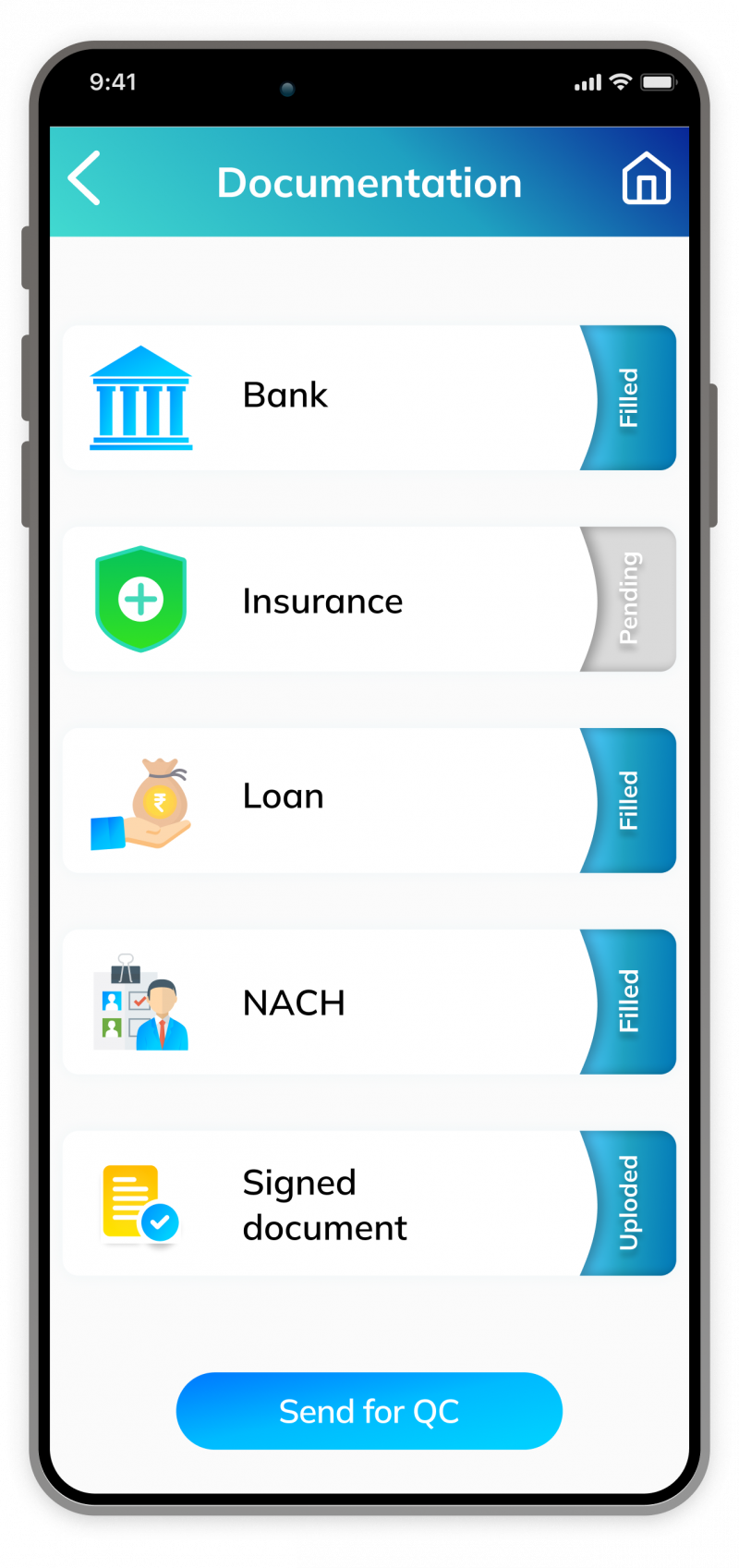

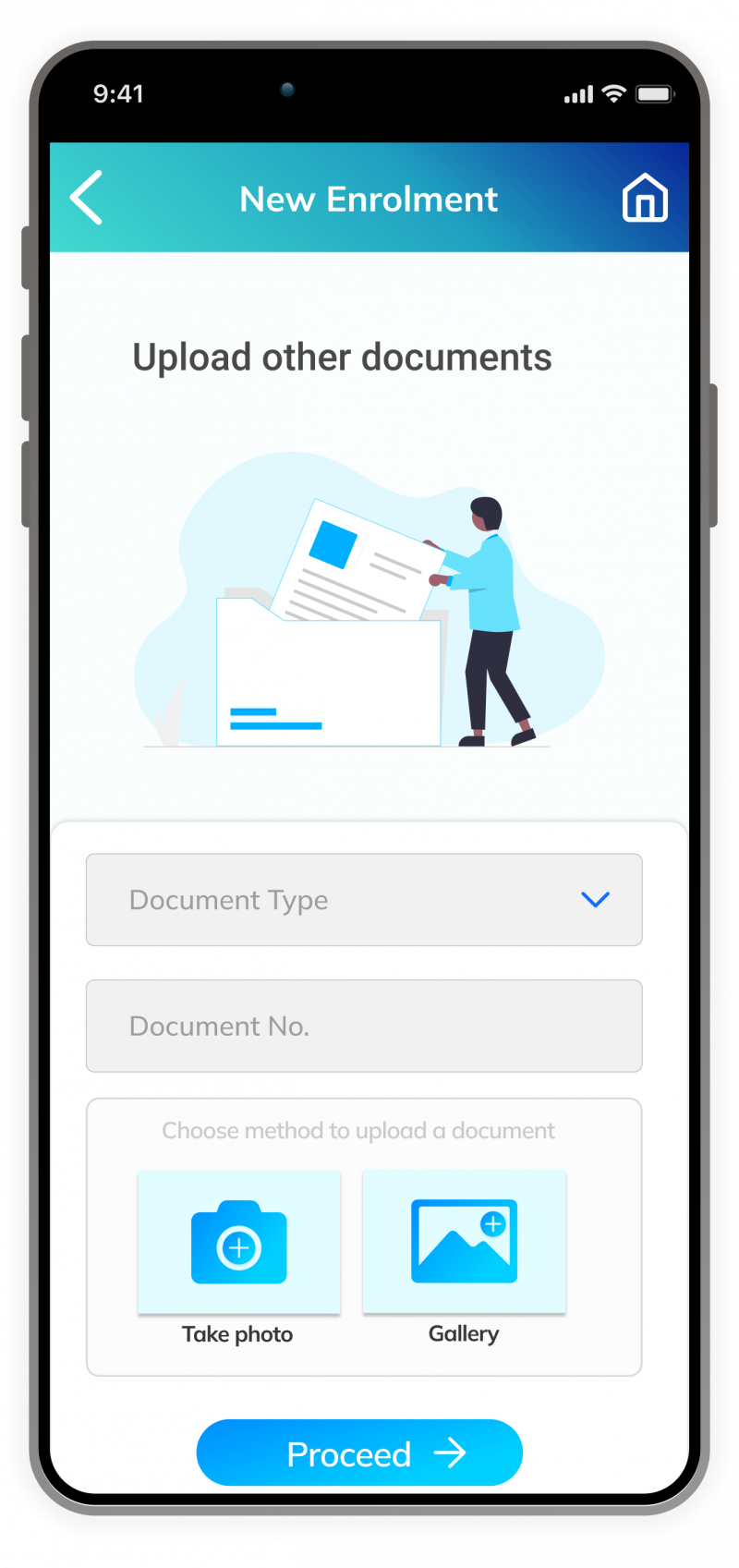

AceN-Navadhan is a tech-enabled finance platform for rural MSMEs with modules capable of handling this segment with financial services along with digital tools . The modules under AceN are:1. eN Enrol – Enables customer onboarding from various channels – Assisted tech, Bulk onboarding and self-administered. OCR based data capture and authentication of the same from regulated entity repositories

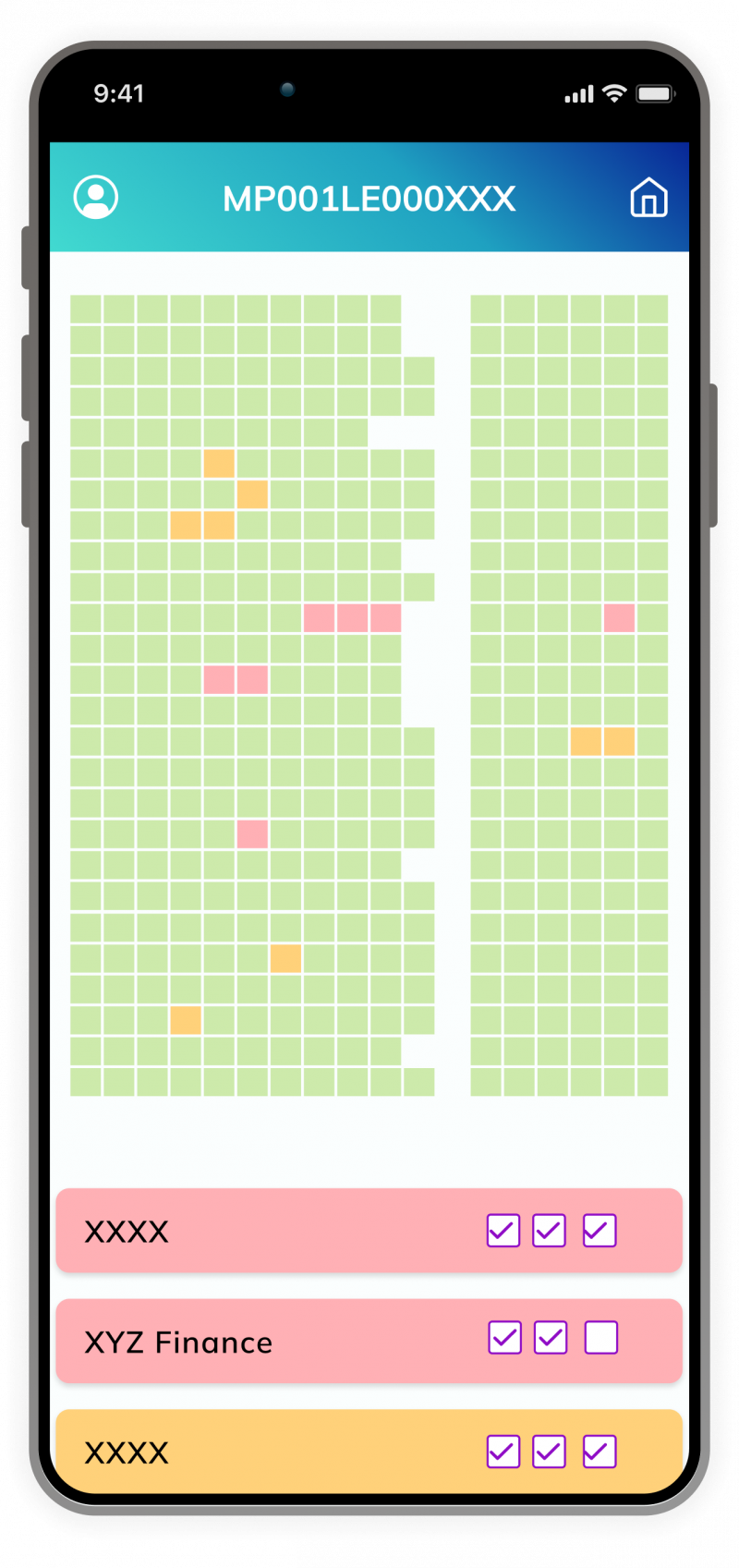

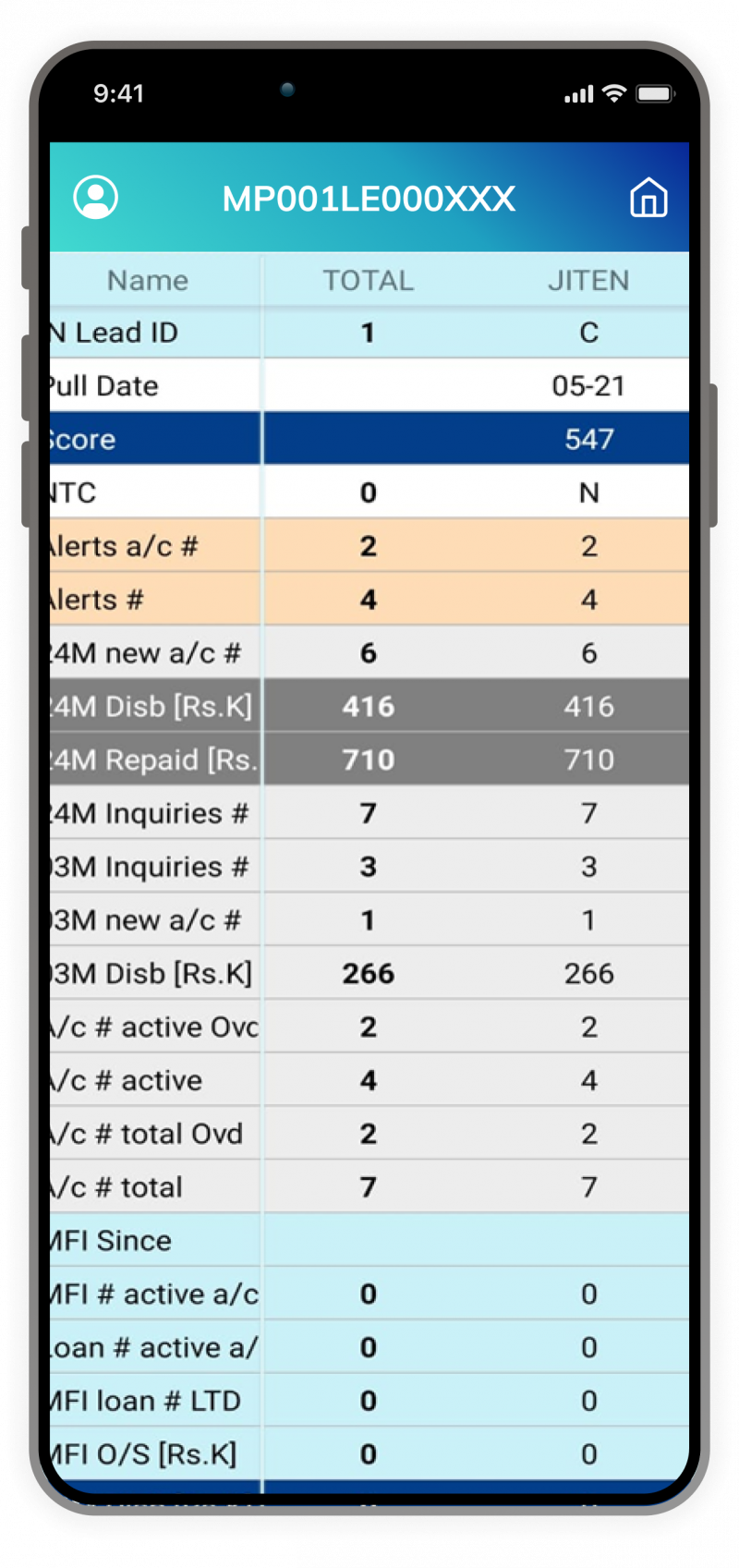

2. eN Credit – CB Tool: Credit bureau data scrub and analytics engine with internally defined rules for rural MSMEs. Credit behaviour/ surrogates based self-learning credit alerts system for rural MSMEs

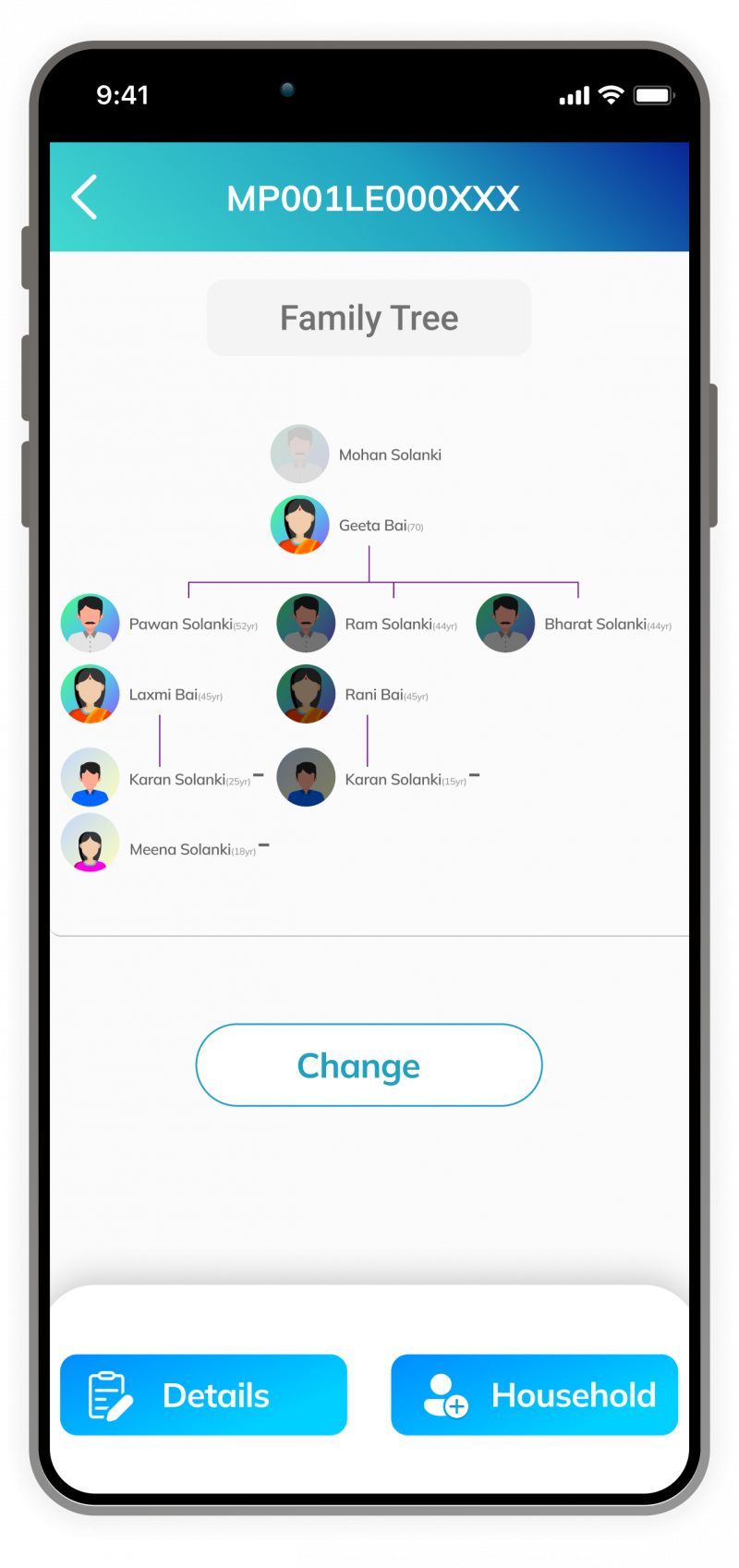

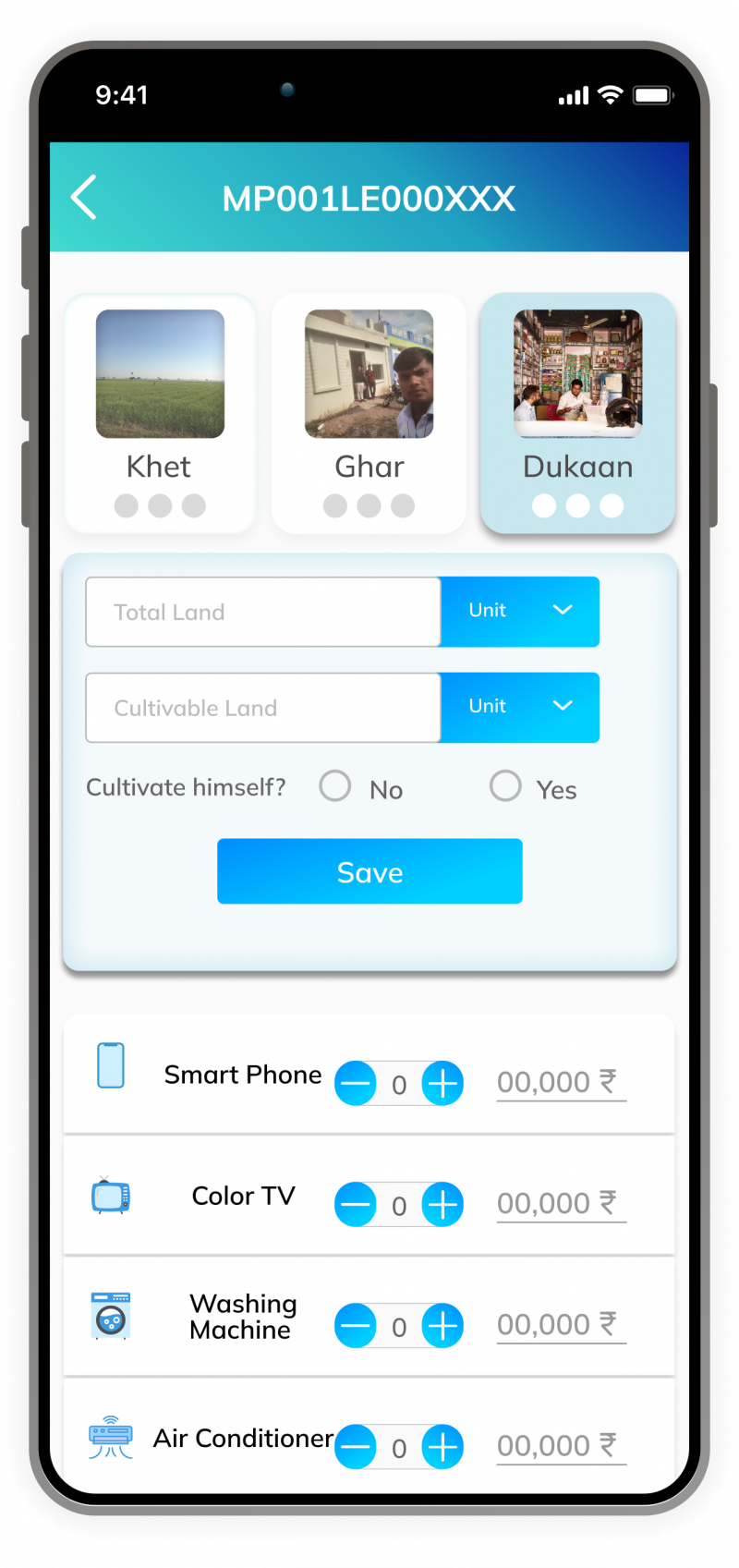

3. eN Profile – Rural MSME proprietor household and asset profiling. Cashflow analysis model – Specially designed for rural MSMEs and businesses for their predictive analytics to derive the cashflow

4. eN Pay – Payment solution for Rural MSMEs which allows payments through both cash and digital modes with controls, alerts and auto-recon

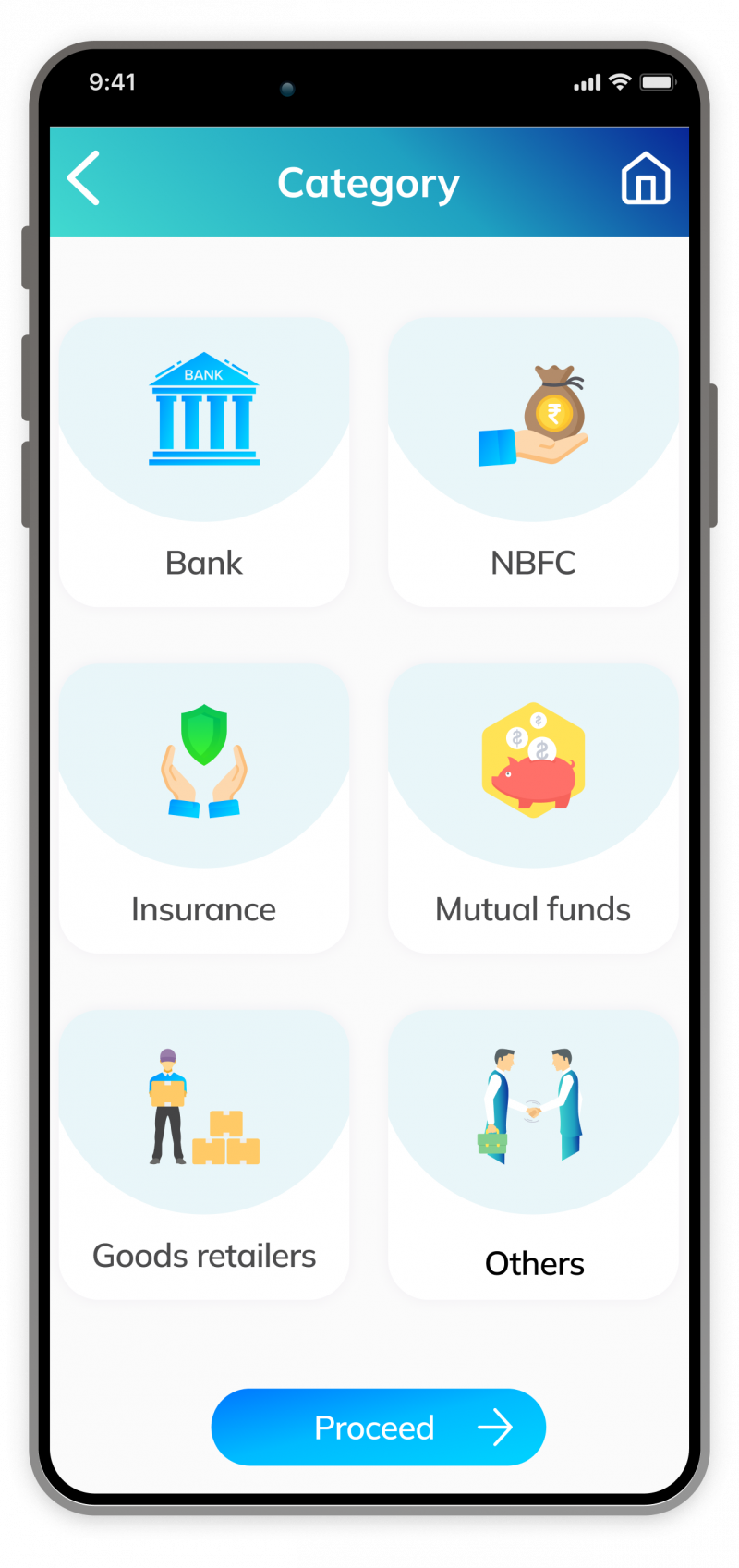

5. eN Partner – Facilitates onboarding of financial institutions on AceN platform to make them assess to this new high yielding rural MSME asset class

6. eN Digi – Digital tools for small businesses to digitise unorganised value chains. D cube (Daily Dairy Diary) – Digital ledger for nano entrepreneurs in the dairy value chain

A fit-for-purpose tech-enabled platform for rural MSMEs, offering suite of financial services covering Loans, Savings, Insurance, Pension, and non-financial digital tools for embedded finance.

Results

a. Last mile reach- We have reached 1,83,000 individuals in the rural areas to cater their financial needs from our platform and parallelly facilitated larger financial institutions to take part in the financial enablement of underserved customers.b. Operational Efficiency- AceN has helped in optimizing the end-to-end process allowing scale up and tight controls on the processes at the same time

c. Accessible for underserved customers- AceN with its deep reach in rural and semi-urban areas, makes financial services accessible for MSMEs who otherwise would have been left out of the umbrella of banks and larger financial institutions

d. Awareness amongst underserved customers - Financial awareness program has been conducted primarily focussed on investment avenues, enabling MSMEs to develop a digital footprint, bank account opening and credit access